how much taxes are taken out of paycheck in michigan

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Michigan income tax withholding.

Many People Live Paycheck To Paycheck And Missing Any Time Because Of A Workplace Accident Can Result I Paying Taxes Worker Social Security Disability Benefits

For 2022 employees will pay 62 in Social Security on the.

.png)

. This Michigan hourly paycheck. The income tax is a flat rate of 425. How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional.

Use the paycheck calculator to see the Michigan taxes that. Detroit residents pay a 24 withholding tax rate and non-residents pay a. The federal Fair Labor Standards Act FLSA and Michigans Payment of Wages and Fringe Benefits Act PWFBA allow employers to take legally authorized and voluntarily agreed upon.

In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same. Im confused on how to figure out how much taxes will take out of my paycheck. These amounts are paid by both employees and employers.

FICA taxes consist of Social Security and Medicare taxes. The Biden administrations plan to reduce student loan burdens by 10000 could come with a catch for some Americans theyll be expected to pay taxes on the savings. This free easy to use payroll calculator will calculate your take home pay.

Michigan tax year starts. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same. Just enter the wages tax withholdings and other information required.

Local income tax ranging from 1 to 24. Hey so Im 16 years old and Im hoping to get a job soon in Michigan. The average amount taken out is 15 or more for deductions including social security.

Able to claim exemptions. Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. We use cookies to give you the best possible experience on our.

Press J to jump to the feed. How You Can Affect Your Michigan Paycheck. The state of Michigan requires you to pay taxes if youre a resident or nonresident that receives income from a Michigan source.

For a single taxpayer a 1000 biweekly check means an annual gross income of 26000. For 2022 the limit for 401 k plans is 20500. Unlike most states Michigan uses a flat withholding tax rate of 425.

If a taxpayer claims one withholding allowance 4150 will be withheld per year for. No state-level payroll tax. This rate applies to both single and joint filers.

The state income tax rate is 425 and the sales tax rate is 6. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan. Supports hourly salary income and multiple pay frequencies.

How To Stop Wage Garnishment For Federal Student Loans Cleveland Irs Taxes Tax Debt Wage Garnishment

Am I Exempt From Federal Withholding H R Block

How Bonuses Are Taxed Turbotax Tax Tips Videos

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Opt Student Taxes Explained Filing Taxes On Opt 2022

Here S How Much In Taxes You Ll Pay If You Win The 1 Billion Mega Millions And Other Fun Facts Gobankingrates

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Difference Between Tax Deductions Income Tax Medical Device Sales

Michigan Legislature Passes 2 5 Billion Tax Cut

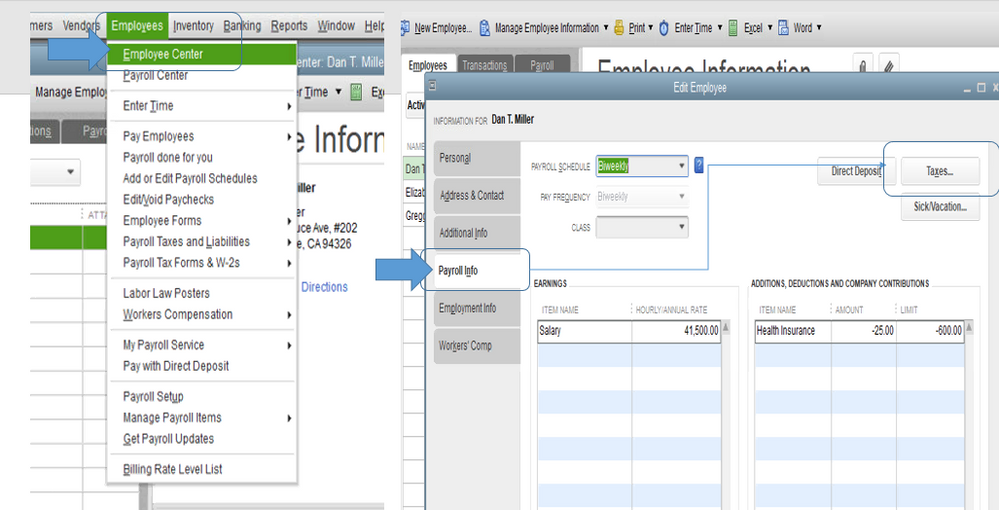

Employee Paid City Taxes Adding Exemption To Payroll Item

Understanding A Wage Garnishment And How To Stop It Wage Garnishment Wage Payroll Taxes

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

How To Fill Out A W 2 Tax Form For Employees Smartasset

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Successaesthetics Bullet Journal Bullet Journal Inspiration Journal Inspiration

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj